We're getting to your messages. Thanks for your patience🙏

Homeowners insurance (or home & contents insurance) is available in Ecuador. But, it's likely to be a little different from what you're used to. This insurance market is still immature in Ecuador, with many locals preferring to protect their homes with other means rather than take out an insurance policy.

We've spoken with Carlos from Blue Box Insurance to get his perspective on how homeowners & renters insurance works in Ecuador. It can really pay to do your research before jumping in and buying the first policy you find. You certainly don't want to end up with a policy that falls apart when it comes time to make a claim.

Let's dig in!

Homeowners insurance covers any kind of event that affects your property structure or the contents of your house. Sometimes it's compulsory to purchase as a condition of obtaining a mortgage to finance the property, but other times a policy is taken out simply to protect property owners against the numerous risks to the contents and the structure of the house.

There are 2 main components to homeowners insurance:

There are multiple insurance companies in Ecuador that do offer home & contents insurance. But, there is a significant difference in the availability depending on which part of Ecuador you call home.

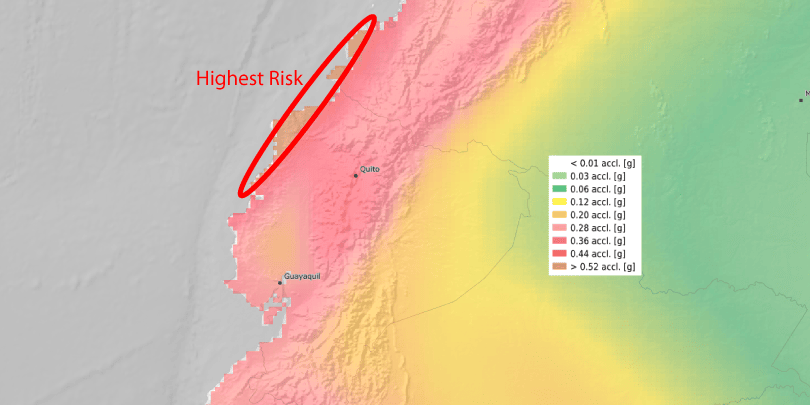

For example, the large earthquakes that have caused damage on the coast over the past couple of decades have resulted in fewer reputable insurance companies offering insurance on the coast. Right now, you're really limited to 2 or 3 quality options for purchasing home and contents insurance if you do live in Manta or anywhere near the coast. If you're beachfront (ie within 500m of the beach) then you'll have even fewer options.

But, if you live in the mountains such as Quito or Cuenca, then you'll have significantly more homeowner insurance companies to choose from. Many of the larger companies that offer homeowner insurance also provide other types of insurance such as health, car & life insurance, so you can potentially have multiple policies with the same company if you want to pursue a consolidated approach. But, our recommendation is to shop around based on the best insurance in that vertical rather than sticking with the same company because it's the only one you know.

Policies generally cover fire, theft, water damage & natural disasters. Civil liability is covered by some, but not all policies. Some policies also allow you to increase the amount of civil liability coverage. You obviously want to read your policy documents to understand the full details of the coverage.

The following are notable exclusions with homeowners insurance:

Don't include the value of your jewelry and cash in the value of your contents as they won't be insured.

Your starting positing should be that artwork is not covered. However, there are some companies that will cover it on a case-by-case basis if you provide evidence of value such as a receipt. These would definitely need to be pre-approved by the company beforehand.

Only items stolen from the insured residence will be covered. ie If you take your laptop to a cafe and it's stolen from there, you can't claim it on your homeowner insurance policy.

Some areas that have a high risk of earthquakes or other natural disasters may not be covered at all by some or all insurance companies. For example, if you purchase a home in the area behind Amaru Zoo in Cuenca, you'll likely find that no company will provide you with a policy due to the previous seismic activity in the area.

But, the company will always tell you in advance that this is the case. It's not like they'll provide you with a policy for that house and then later deny a claim.

No, land value is excluded as no insurance company will cover it. For example, if you purchased a property for $250K and the value of the land is $50K, then the maximum you'd be covered for is $200K.

The main differences are the number of choices available (there are more insurance companies in the US) and some of the exclusions. For example, it can be common for US policies to exclude tsunami events in certain locations. Ecuador doesn't have the same restrictions for tsunamis, but they do have a general distinction & limitations for coastal properties.

The other significant differences are with the claims processes & the laws surrounding the appeal of any denied claim.

The insurance market is certainly growing in Ecuador, but Ecuadorians simply don't have the same history of insuring their assets that we're used to. Some prefer to only focus on increasing security measures such as cameras, fences & dogs but don't see the structure of the home itself as something worth paying extra to protect.

It's becoming more common to find mandatory insurance requirements when purchasing via a mortgage etc. This is helping insurance to become a more mainstream purchase.

All apartment & condo buildings are required to have insurance for the structure of the building. The insurance payments are automatically included in the monthly aliquota (or HOA) fees. However, even if you own an apartment that has this mandatory insurance, it may still be worthwhile to purchase the following additional policies:

If you do solely rely on the mandatory building insurance and there is an earthquake or other incident that destroys the building, then the insurance company may take several years to rebuild the entire structure. You aren't compensated for lost rent or other opportunity costs during this time. But, if you have a separate policy, then the insurance company will pay out the cost of the apartment and you can then purchase another apartment or do whatever you want with the money.

The other potential issue to look out for with mandatory building insurance with apartments is the insured value. Unscrupulous building managers may opt to insure the building for a lesser value in an effort to save on insurance premiums. Then, if something does happen to the building they find that they are underinsured and can't rebuild.

I believe this is the case with some of the abandoned beachfront buildings you can still see at Bahía de Caráquez from the 2016 earthquake. These buildings have clear earthquake damage and are not habitable, but they are still standing with no signs of them being replaced anytime soon.

It's common for the insurance company to inspect your property as part of the process when purchasing coverage. And, they will take into account the risk profile of the neighborhood and then recommend security measures, such as installing cameras or an extinguisher, that you'll need to comply with before you'll be covered.

If you don't comply with adopting these measures (and send proof), then the insurance company may have grounds to refuse your claim.

For example, if the insurance company requests that you install security cameras but you fail to do so and are robbed, then they'll likely turn around and say that you didn't comply with their requirements and will refuse the claim.

Claims do get routinely denied by insurance companies here so it's very important that you understand your rights to appeal any decision. Hint - you definitely have a right of appeal but you also have strict timeframes for lodging the documents.

There are separate premiums for the structure & the contents. For example, you may have a policy that covers the structure of the house up to a value of $300K, with the contents insured for up to $20K.

Location can play a very significant role in determining the cost of the premium. For example, homeowners insurance in Manta will likely cost 15-20% more than in Cuenca just because of the increased earthquake risk.

But, there can also be significant differences within these areas too. For example, a property in Cuenca's Centro Historico area may attract a premium of 30% more than if it was in a different neighborhood. The main issue here is the damage that fire can quickly cause to these houses and the high cost of rebuilding patrimonial houses.

All homeowner claims need to be submitted to your insurance company within 5 days. If you fail to do this then the insurance company will likely deny your claim.

Note, that it's 5 days from the time you're aware of the issue. For example, if you're away on holiday and your house is robbed, then you'll have 5 days from the date you discovered the robbery to lodge your claim.

Even if an insurance company doesn't explicitly request an itemized list of the cost of your contents, it's always a good idea to create one as it will make the claim process a lot easier.

If you're bringing household goods in a container, then you'll likely have this list already, you'll just need to ensure that you've also provided reference costs for each item. You don't need to provide invoices as evidence of these costs.

Be sure to update your policy if you purchase any new items you want to be covered. For example, if you buy a new flat screen TV, then send the invoice to your insurance company so they can include this in your policy too. If you don't update your policy, then you'll likely find it won't be covered if you do need to make a claim.

In cases of theft, where your goods were stolen but you don't have invoices, you can use a notarized 'declaración juramentada'. You can then use this legal document as evidence of the goods that were stolen and the insurance company will then start the process of calculating the commercial value of these items.

When making a claim, the amount you'll pay as a deductible will change according to the type of claim. For example, a claim for earthquake damage or total loss will generally have the highest deductible. Whilst a deductible based on water damage or broken glass will attract a lower deductible.

Insurance companies will often cap the payout of theft claims to around 50% of the maximum insured value. Why? The rationale is that in the case of theft, they generally can't take all of your belongings such as large dining tables, beds etc. You can generally increase this payout % by paying extra on your premiums.

The best insurance brokers can help act as an important buffer between you and the insurance company. Particularly so if they are willing to use their purchasing power as a lever to help ensure any claims are accepted without issue

To illustrate, if you purchase homeowners insurance from one of the lower ranked, or less reputable, companies in Ecuador, then there is an increased chance that they'll deny your claim at first instance to see whether you're going to fight it. Whilst I find these sorts of business practices abhorrent, you should absolutely know that it is a tactic used by some companies. And, if you aren't aware of your right to appeal this decision, or the process of how to appeal, then it's easy to see how it can end up costing you a lot of money in unpaid claims. You can find rankings by sales volume at the Superintendencia de Companias, Valores & Seguros website.

But, if you use a broker that brings in substantial business to the insurance company, then the broker has several levers to push to help get your claim processed. The broker can also help with appealing any denied claims.

The most obvious advantage of using a broker is they aren't tied to one particular company and can provide more options that may be better suited to your circumstances.

Most of the information in this article has come from one of our preferred insurance partners, Blue Box Insurance. This company is highly regarded in the expat community and is renowned for providing quality after-sales service - which can be hard to find in Ecuador.

To request a homeowners insurance quote, please provide the following details. This form is sent directly to Blue Box and they'll provide a response within 24 hours.