We're getting to your messages. Thanks for your patience🙏

One of the key considerations of expats moving to Ecuador is health insurance and the quality of healthcare. And, rightly so. This can be especially true for those coming from the US where the price of healthcare continues to soar, making it unaffordable for many retirees to continue to live there.

This guide provides all of the information you need to make an informed, unbiased decision on what type of Ecuadorian health insurance is best suited to your circumstances.

I'm going to include several plans that were recommended to me by my broker below. These plans are obviously not exhaustive, but I think they cover the most common scenarios and provide a good ballpark of expected costs, coverage amounts and deductibles.

Healthcare costs in Ecuador are generally a fraction of what you'd pay in the US. Many procedures come in at around 15-20% of what you'd pay in the US. The low cost of healthcare is a key contributor to the overall low cost of living in Ecuador, which can be a core reason why expats decide to call Ecuador home.

The low cost of healthcare actually opens up the option of self-insuring for the small things such as the occasional visit to the doctor. But, if you take this path, I'd still recommend having insurance to cover anything major as these fees can still add up and put you under significant financial stress.

Without insurance, you can expect to pay around $30-40 for a consultation with a general practitioner and $40-$50 for a specialist. Often, a quick follow-up visit (to discuss results etc) will be free.

Dental care is also great value, with the cost of a filling generally around $30-$40, and a basic cleaning around $30.

Prices tend to be highest in the larger cities, but you also have a lot more options.

This can be a tricky one to answer and you should be skeptical of any publication that builds Ecuador up as some type of health care utopia. It simply isn't. Like any developing country that offers universal health care, there are strains on the public health system (IESS) that can affect you if you go down this path.

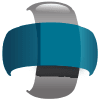

I've tried to use some health care rankings to provide some level of objectivity when comparing how Ecuador performs against other countries, but I found so much conflicting information that it defeats the purpose. Some have Ecuador in the top 20, others have it struggling below the top 50.

Numbeo currently has Ecuador ranked at 31 (in 2021), one place behind the US at 30. This is self-reported data, so it also has its limitations. Another popular ranking system is Bloomberg's Health Care Efficiency, which as of 2020, has Ecuador slipping 6 places to rank 47 (US is ranked 55).

Whilst tempting, it's also difficult to base your decision on first-hand, anecdotal data. I've seen many first-hand reports from expats that really praise the quality and attentiveness of healthcare in Ecuador. But, I've also seen some negative (I also have some of my own I can share). I can say the positive stories substantially outweigh the negative. It can be easy to hear one emotional story and then paint the whole health care system accordingly.

My personal opinion is that the private healthcare system in Ecuador is high quality and great value. The public health care system still has high-quality care, but it doesn't allow for the flexibility that I desire.

Ecuadorian doctors are generally highly trained, with many opting to obtain at least part of their education overseas. This has generally been my experience too, where the knowledge and care of the majority of healthcare professionals I've seen here (mainly in Quito & Cuenca) left me feeling like I was in safe hands.

Doctors earn a good salary in Ecuador, but it certainly isn't as lucrative as in some developed countries. This not only translates to affordable consultations, it also means your doctor's intentions are more likely to be based on good health outcomes for you and less likely to be tainted by financial reward.

The quality and freshness of equipment ranges from state of the art to almost non-existent. The newer, private hospitals in big cities have high-quality, new equipment. Whereas small, public clinics are likely to be using very dated machines & equipment.

Our current gynecologist mostly uses a very modern ultrasound scanner, but they also pull out an ancient doppler that looks like a VHS machine from the 80's. If it still works well, Ecuadorians are less likely to replace something just because it's older.

The design and aesthetics of hospitals and clinics are not high priorities. This can be a little off-putting for expats that are used to super expensive, modern, well-designed hospitals. But, I've learnt not to judge a hospital here in Ecuador by its cover.

You will find that doctors in Ecuador have a higher chance of speaking English compared with the general public - especially if they've studied overseas. But, you should not assume that your doctor will speak fluent English. That said, they will most likely understand many English medical words because these are generally favored by the medical community and not translated.

The government has flipped flopped on this a few times. Right now (mid 2021), you do NOT need health or travel insurance to enter Ecuador.

You do need health (or a travel insurance plan) to visit the Galapagos. Whilst part of Ecuador, the Galapagos have their own rules and regulations that can sometimes be quite different to the mainland.

Maybe. This requirement currently depends on the type of visa you're applying for.

You'll require proof of health insurance when you submit your visa application.

For all other common residency visas (Professional, Investor etc), you won't require health insurance as part of your visa application, but you'll need it before you can apply for your Ecuadorian identity card (cedula) - more on this below. We've previously covered Ecuador residency visas & recent visa changes (2021 & 2022) in detail.

We're predominantly covering domestic health insurance available in Ecuador in this article. If you're a foreign resident only visiting for a short period of time, then you'll most likely just want to stick with the travel insurance you've purchased from outside of Ecuador.

Note, some Ecuadorian health insurance plans also offer a limited amount of travel insurance which can be a great value-add.

Ecuador has two distinct healthcare systems. The public healthcare system (IESS) is based on universal health care models - similar to Medicare in the US. And, the private health care system that competes with the public system, helping to keep the costs low.

A recent trend that might sound a little weird at first, but can be effective in some circumstances, is to combine both public and private cover.

The current public health insurance system was formed in 2008 when the constitution was re-written, and for the first time recognized health care as a human right.

The Instituto Ecuatoriano de Seguridad Social (Ecuadorian Institute of Social Security), or IESS system has come under pressure recently, with the COVID pandemic adding even more strain to a system that could definitely use more government funding.

If the IESS hospitals are full, they may opt to send you to a private clinic or hospital. But, this needs to be organized by IESS beforehand. They won't reimburse you if you decide to use a non-public hospital.

Whilst you are covered for emergency care straight away, you'll need to wait 3 months before you're eligible for many benefits.

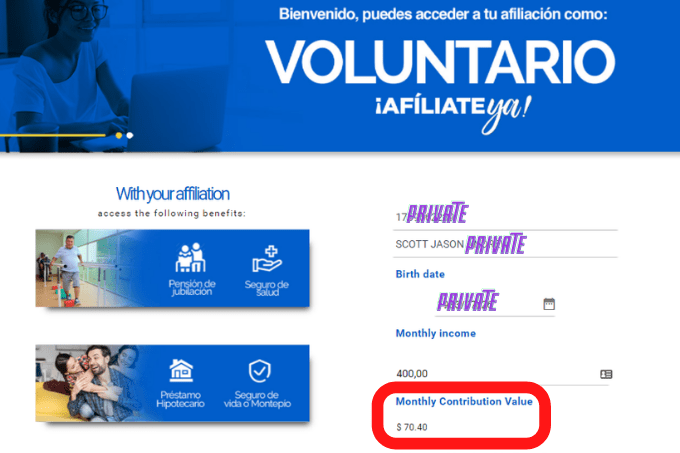

Public care with IESS can either be mandatory through your Ecuadorian employer, or voluntary. If you don't work for an Ecuadorian employer, then you'll want to apply for the voluntary contribution. Many expats use the basic minimum salary of $400 as their declared income, which equates to a monthly premium of around $70 payable to IESS (see screenshot below)

Ecuador has around 30 private health insurance companies to choose from. Some of these are part of bigger international health insurance companies, whilst others only operate within Ecuador.

They are all regulated by the Superintendencia de Companias, which also acts as an adjudicator should you run into any problems.

Depending on the type of residency visa you're applying for, you may not require health insurance as part of your application. But, you'll definitely need it before they'll give you a cedula.

The catch? You need your cedula before you can obtain insurance via IESS, leaving private insurance as your only option.

Some opt for the most basic cover they can find simply to fulfill this requirement and obtain their cedula. This can be a good option if your preference is to obtain IESS as soon as possible.

But, if you actually want to use it, then I'd suggest taking a little more time to choose the plan that works best for you in the long run rather than having to go through the process twice (once for cedula, once when looking for 'real' insurance).

I've witnessed a very strong trend amongst retired expats that choose to base their retirement location primarily on access to quality healthcare. And I completely get it as I'd most likely do the same.

If you're also in this boat, you need to know that this will put significant limitations on the towns and cities within Ecuador that you can comfortably retire in. Notably, those that want to live by the sea generally choose to live near Manta or Guayaquil, and those that want to live in the mountains choose Cuenca or Quito.

This is not to say other areas are not worthwhile checking out, but I suggest paying particular attention to how close you'll be to a major hospital. This can literally end up being a life or death choice for any medical emergencies.

There are various factors that affect the monthly price you'll pay for the premium, including:

Premiums increase as you age. Unfortunately, the plans generally don't lock in your age at the time of purchase, so you may pay more as you get older.

Females can sometimes pay more than males as they've been deemed to be more at risk. Maternity cover in particular will push up your premium significantly.

Private insurance companies generally divide Ecuador into 3 different locations; Austro, Costa and the Sierra which can affect the overall price of the contract.

Finding a quality plan that covers pre-existing conditions (even after the 2 year waiting period) can be difficult and will most likely push the price up.

A higher amount of cover per incident will generally equal a higher monthly premium.

You may pay more if you're a smoker.

Some of the more comprehensive plans include travel insurance. If you don't need travel insurance, then choosing a plan that doesn't include this may provide better value for you.

We provide some example plans & pricing in the table above.

This can be a significant deciding factor in whether to choose IESS which only has a 3 month waiting period for pre-existing conditions vs a private plan which won't cover these for 2 years.

Even after the 2 years, you may find that private plans offer limited coverage per incident for any pre-existing conditions.

It definitely pays to shop around as some insurance policies are much better than others in how they treat pre-existing conditions.

You'll be required to go through a questionnaire with your agent or broker to disclose any pre-existing health conditions.

Knowing which hospitals and clinics are included as "In-network" can be a deciding factor. For example, one of the reasons I chose my plan was because it included Hospital del Rio in its network. This hospital is my favored one here in Cuenca mainly because it is the closest one to us.

You will generally be reimbursed 90% if you use In-network facilities, whereas you'll receive 80% if you go outside of the network.

Dental and optometry are not covered by private insurance. You'll need to pay for teeth and eye care out of pocket or use the IESS network.

Given there are around 30 health insurance companies in Ecuador, choosing the one that's best for you can be a little intimidating. We suggest basing your decision on the following:

Not all insurance companies are created equal. Some companies can be a lot easier to work with than others. Some have more English-speaking staff than others, whilst others have reputations for not reimbursing.

Obviously, price is one key factor. But, you also need to consider whether you want a high or low deductible, and what exactly the cover is for (comprehensive or just major surgery etc).

I suggest talking to other expats about their experiences with private care and getting reimbursed by each company. This is especially important for hospital visits as you may need to pay upfront before they'll let you leave the hospital. You don't want to be waiting and hoping that the insurance company is going to reimburse you.

The ease at which you can cancel a contract should you need to can be an important consideration. Ecuadorian companies are notorious for continuing to direct debit your account, even if you've canceled (or tried to cancel) the contract.

Is it clear that the insurance agent (or broker) is in a rush to make you sign the contract? Have they made any effort to cater to your specific needs and circumstances? These are pretty clear red flags and you shouldn't be surprised if these same agents provide zero after-sales support.

Perhaps it's the lawyer in me, but I absolutely recommend going through the exclusions with a fine-tooth comb. You may be quite surprised at what is not covered. Some possible exclusions:

Yes - so long as it is not a pre-existing condition. ie If you buy insurance today, but go to the hospital tomorrow presenting symptoms, you will not be covered. You'll generally need to wait around 10 days for COVID to be covered.

To get reimbursed, you have 90 days to submit your claim. After this time they will NOT reimburse your claim. It's important to try and get these submitted earlier than the 3-month deadline in case they ask for more documents.

This is where it's important to choose a reputable insurance broker that isn't just a puppet for the insurance companies. If your claim is denied, you should be able to lean on your broker for assistance in submitting an appeal to the Superintendencia de Companias who will then assess your case, including all of the documents, before ruling whether the insurance company must pay your claim. This can take between 3-6 months for the decision to be made.

It might actually make more financial sense to combine IESS & private insurance. To illustrate this I've provided several different possible scenarios below.

There's a lot for new expats to take in when deciding which health cover is appropriate for them in Ecuador. Hopefully this guide has answered many of your questions, but if you need more guidance feel free to contact us and we'll do our best to point you in the right direction. You can also check out our guide on homeowners & renters insurance.

If you'd prefer to talk to an expat-friendly insurance broker or would like a quote, complete this form and it will go directly to our recommended insurance partner (they will respond within 24 hours - normally a lot sooner).

Already have insurance? We're interested in your experience, so feel free to comment below.

Hi

Im an American residing in Cotacachi and would appreciate a local broker referral who is able to guid me through the private health insurance process. English speaking and licensed broker will allow me to make an informed decision. I appreciate all the valuable information given in this article.

Regards

Cherie

Thanks Cherie - I've provided the referral via your email. Please let us know how you get on 🙂

I would appreciate a broker to contact for shopping for private health insurance.

Hey Lisa, I believe you were able to send our recommended broker a message. Hopefully, they're looking after you well and you've received the quotes you're after. Feel free to keep me updated throughout your experience.

I am curious on how to find out if an insurance company will cover the cost of an infusion medication my wife has to take every 6 weeks-given at a doctors office-or how much it costs out of pocket if it covered. Any recommendations on how to get that information? Thank you

No problem Jeff. I've emailed you our recommendations.

I, also, am looking for an insurance broker for purchase of private insurance. Thank you for any recommendations.

No problem Anders. I've emailed you a recommendation.

Good afternoon,

Would you mind re-emailing? I didn't receive the first one. Probably left the digit out of my email address. Thanks.

Hey Anders - I've resent it. Perhaps check spam if still no luck. You can also message us on FB 🙂

Hi,

We only need health insurance for the Cedula we have private insurance but we don't want to go through the hassle of having everything apostilled etc since we are already in Ecuador. Can you recommend a health insurance that would be easy to cancel.

Hi Ginger - sure. I've emailed you a recommendation. Let us know how you get on 🙂

Hi Jason, terrific info and fantastic site, very helpful. Can you recommend health insurance broker? Moving to Ecuador next month. Very much appreciate any info. Thanks so much! Jerry

Hey Jerry - thanks for the kind words. Sure thing, I've emailed you a broker recommendation.

My 61 yo wife and I (65 yo) are planning to relocate to Cuenca in March. However we intend to keep our home here in the US and continue to occasionally visit family as well. Our biggest concern is if something catastrophic happens to us during one of those visits and we’re not covered by Medicare or Obamacare how do we avoid potential financial destruction? Healthcare costs in the US can quickly become incomprehensibly astronomical and lead to complete financial ruin under the right circumstances. You don’t really hear about this in other countries but it happens all the time in the US. But if my wife and I were to maintain health coverage here in the US in order to avoid such potential financial catastrophe AND were also paying for health coverage in Ecuador (even if it’s just IESS) that all seems to defeat the purpose of affordable living abroad.

I hear you Michael. Your biggest expense will be maintaining US insurance. So, perhaps stick with Ecuador health insurance (private or IESS) and just take out a travel insurance policy when visiting the US? There are some companies that offer travel insurance for US citizens travelling back to the US. Not a recommendation, but a quick Google turned up this travel insurance provider that caters to your circumstances. Feel free to let us know if you do end up buying such a plan (and bonus points if you write back to us and let us know about your experience).

if we just want a cheap insurance for a month only to get the cedula and then apply for IESS and not have to give a credit card or bank account number so they do not continue to debit our account and it cancels out simply by not paying it any longer what would that policy be in Ecuador

Robert - you'll need to find a broker that is willing to go sell you a contract for one month. Most won't as it's not worth their effort (the commissions for one month are negligible). I can provide a recommendation for a broker that is willing to provide 3 months if that is of interest.

Nor seeing anything about prescription drugs

Not sure I understand Paul. Do you have a question here?

A person who is 65 years of age will have Medicare in the United States, for which the current premium is about $130 per month, so that would appear to rule out medical bankruptcy for the senior partner. Otherwise as suggested.

Thanks for your input Jonathan. I'm not entirely sure who you're addressing this comment to though. Feel free to let me know if you think there are factual inaccuracies in the article - more than happy to correct these. Cheers

The response was to the 65-year-old gentleman and his wife who posted an inquiry just above.

However I have another question. Do you have to wait 3 months before you can apply for IESS? I have made several attempts to apply for iess online, but the process seems to fail each time at the last hurdle and hang up. Could this be because I have not had my cedula for 3 months yet, but they have no information message available to explain that I am applying prematurely?

Got it - thanks for clarifying!

Did you have success registering for IESS? I don't believe you need to have your cedula for 3 months before you can apply. But, you do have a 3 month waiting period for some services. For IESS or health insurance questions, feel free to send Carlos a message and he'll be able to confirm it for you.

heck I've been in IESS for 9 years but how do I get out of it as I am in Australia now and can not get back there?

Hello Jason:

We are retire US expats living in Colombia and looking at a possible relocation to Ecuador. Would be interested in your health insurance broker contact info.

Thanks: Gloria

Hi, we finally got our visas, and now working towards the cedula. Would you mind sending the info for the 20USD/month insurance? Thanks a lot for all the useful information!

Hi, I need to renew my cedula, I have insurance in Ecuador but not sure if it fills the requirements. Can you send me the information on a broker who sells insurance that is low cost? Thanks.

I recently received my retirement visa and cedula in Ecuador and am wanting to enroll in IESS. I am 72 yrs old and getting conflicting info on websites. 1 says 17% of SS another says over 65 different. Can you help me with this or point me to a facilitator in Salinas?

Good afternoon Mary. I've responded via email and also had a facilitator reach out to you via email. This process should be pretty straightforward. Do feel free to reach back out if you need further help.

Hi, could you please recommend some companies and plans that meet the requirements for getting a cédula, looking for something inexpensive and easy to cancel in case I would like to switch to IESS after I receive my cédula. Thanks

Hi,

Nice website, I'm planning to move to Ecuador soon.

Can I use a swedish insurance to obtain the cedula or can I just go to Ecuador and get a private insurance and then go for the cedula? The moment 22 is only for the public insurance (IESS)?

Thanks a bunch in advance.

Nic

Hey Niclas. Sorry, your Swedish insurance won't be accepted for the cedula. They have a list of approved private Ecuadorian health insurance companies that you need to use. Happy to recommend a broker if you need this help - just contact us.

Hello! It was informative to read the articles, and comments. I am 67, just received my temporary visa, have a bank account, have the initial cheaper insurance to get my cedilla soon. My insurance was through Carlos; but, was wondering if you have other brokers than him? I have been a bit aggravated working with his company. I want to add a private insurance, but don't get why I should pay for a company who won't cover preexisting conditions for 13 months. Anyway I need someone with PATIENCE to explain these things. Thanks

Hi Jason,

I have read on the insurance, but the most practicable question I have is how do I find a doctor??? I want to see a doctor, and will pay for it myself, this would also lay the groundwork for an exisiting relationship. However, how do I find a doctor???

Hi Aaron. There's a bunch of ways. You can get a recommendation from people you trust or inquire at quality hospitals. Some expats like to use a facilitator that acts as the bridge between you and a doctor (ie you tell the facilitator the type of doctor you need and they'll make the appointment and even accompany you to the appointment if you need it). We do work with some of the facilitators so feel free to contact us if you need assistance.

Hi

Now that the income requirement has gone up to 1275 for a visa what will the public insurance be for a pensioner? Is the cost different if you choose to do an investor visa and are only required to prove 425 dollar income?

Thanks you

First I have to mention that this is an awesome site. You have provided a great service and I want thank whole heartedly for it.

My question is, can you apply for IESS before applying for temporary residence?

Thanks Ken. No. You need a cedula before you can apply for IESS. And, you'll need temporary residency before you can get cedula. You'll need private health insurance before they issue a cedula.

Hi Jason, great article. Im 63 in April and moving to Ecuador in June. I have two preexistent conditions. One which im in the clear, but is still monitored every six months with blood work and the other which I get a yearly infusion of one medication. I very infrequently (maybe once a year or longer) use an inhaler for asthma. Other than that, I don’t take any medications and am in generally good health.

I have spoken to two agents. To see what was the best fit. Although they did give me information, when it was time to answer my very specific questions about the policies and how they would work for me, they answered the questions, but also I felt that they felt a bit put off, or maybe felt that I asked “too may” questions. For instance, there were things I didn’t understand in the policies and when I had questions, I would get one word answers or sometimes my questions would not even be addressed. I started to feel like maybe they thought I was too much work/trouble. I just simply want to truly understand how these policies and agents work, since they are so different than the US, so I can make an informed decision on which policy to sign up for and which agent to go with.

Now I’m feeling like even if I chose one of them, I’m not sure I trust that they would go to bat for me with an insurance company should they refuse to pay. Anyway, any suggestions, would be greatly appreciated.

President Lasso's Exec Decree changed that up a bit. Those applying for a rentista visa or rentier for remote work, health insurance is a requirement. Per the decree, which recently became effective, "Additionally, you must present valid national or foreign health insurance for the same period of the visa. In

case of being contracted with a foreign company, the policy or the contract must indicate that it has

coverage in Ecuador." (Articles 63 and 64, translated decree, link here: https://acrobat.adobe.com/link/review?uri=urn:aaid:scds:US:78488e4b-943f-3ba5-ac55-bbc133d967cb)

Thanks Cindy. Indeed, Rentisa & Retirement visas do now require health insurance as part of their application. I've updated the article to reflect this change.

IESS has a Mortuary Benefit that pays for your cremation or burial. I don't think any of the private companies offer that. Some funeral homes will bill IESS directly and you don't have to pay anything up front. Be sure to ask them.

Just to update here. We both got our cédulas this week and we were not asked for health insurnace. These are temporary cedulas as we are on temporary visas.

I noticed the lasrt post here was in 2022. Many times these websites live on while the agencies have long since disolved. Are you still active?

You're asking whether the insurance broker we recommend for these quotes is still active? Yes, very much so. They've just opened another office. Thanks for the question.

Thanks. This site is extremely helpful.

I joined IESS. But my question is that will I receive the bill each month? If missed monthly payment, what would be happened?