We're getting to your messages. Thanks for your patience🙏

One of the first questions new Ecuadorian expats ask is 'how do I send money to Ecuador and is it expensive?'

The answer is, well, it depends. Like many Latin American countries, transferring money in and out of Ecuador has traditionally been problematic, expensive, and time-consuming.

These difficulties arise through the combination of weak governmental oversight, tough anti-money laundering measures and lack of innovation from the banking industry. This can result in a not so great experience for the end consumer.

Hopefully this guide will provide you with the best options on how to transfer money into Ecuador.

You have several options for transferring amounts of $500 or less into Ecuador.

If you're only here for a short period of time as a tourist, or don't have an Ecuadorian bank account, then ATMs are going to be your best bet.

Pro Tip: Sign up for a bank account in your home country that reimburses ATM fees such as Charles Schwab or Fidelity. But, be aware of any fair use policy and I would not suggest telling them you're just about to move overseas...

There are several services you can use to transfer from your home bank direct to your Ecuadorian bank or for a cash pickup.

This is my preferred method for payments up to $3000. But, I've still used it for smaller amounts as it is quick (24 hours generally) and I can transfer straight into my Ecuadorian account, so I don't need to worry about walking around with a wad of cash after visiting an ATM.

My preferred method is WorldRemit because it offers the cheapest fees and I find it user friendly. Western Union is also quite popular, but is generally a bit more expensive.

Pro Tip: Use my WorldRemit refer-a-friend link and you'll get $20 credit to make your first transfers.

This is where the online money transferring services shine. They are quick, safe and cost effective.

I was a long-time devotee to an online transfer service called Transferwise, but they do not operate in Ecuador. Whilst annoying, this did lead me to comparing all of the various online services that would allow me to easily send money into Ecuador.

My recommendation is WorldRemit because they are the cheapest and I've found their support to be helpful the one time I needed it.

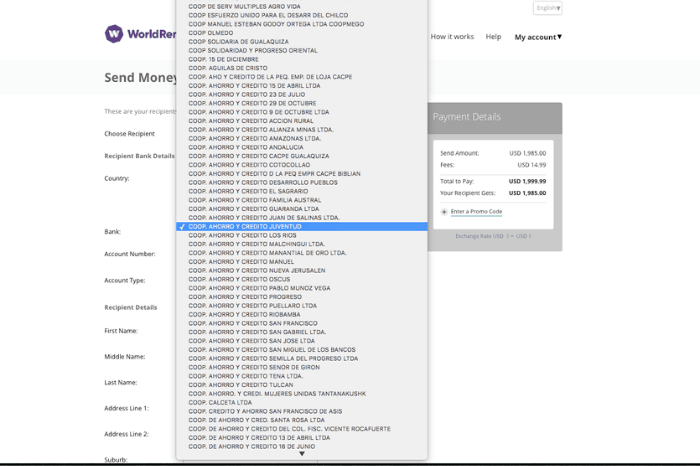

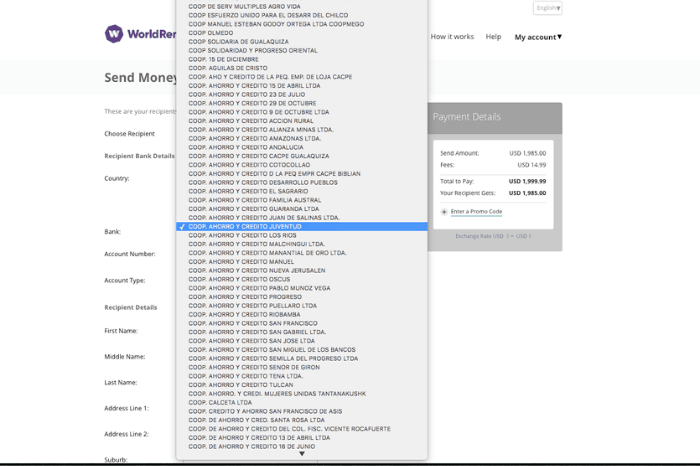

I actually needed to contact them because I couldn't find JEP in their long list of Ecuadorian banks and cooperativas they transfer money into.

Hint - WorldRemit calls JEP "COOP. AHORRO Y CREDITO JUVENTUD" as shown below:

The fees will increase depending on how much you are sending. But, for reference, a $2000 transfer will cost $15 with WorldRemit. This compares well to other services such as Western Union where fees are $20+.

For larger transfers you'll be limited to bank transfers and checks.

Each Ecuadorian bank has a different policy and will charge different amounts for wire transfers. Your best bets are the larger banks such as:

Expect to pay at least $50 to your Ecuadorian bank for a wire transfer + the fee from your home bank. If you're transferring from the US, then you won't have to consider exchange rates, but if your home bank is an another country, then you will.

Note, transferring amounts $10K or greater will trigger the bank to ask you a bunch of questions around where you got the money from. They are required by law to ensure that the funds were legally obtained (ie not through drugs, money laundering or a scam). This is not normally a major burden, but just adds another step to the process.

Again, you definitely want to check with your Ecuadorian bank on their policy for accepting checks. Pay particular attention to the limits and expected processing time as it can take 3-4 weeks for checks to clear.

Not directly, no. Whilst it would be convenient to be able to withdraw cash straight from Paypal into a local account or ATM, that isn't possible.

You still have a few options to get your cash into Ecuador which are similar to the above, but with the added step of transferring from Paypal first:

Transfer from your Paypal account into your US (or other home country) account. Use your foreign debit card in Ecuador to withdraw from an ATM.

Send from Paypal to an online transfer service such as World Remit, Western Union, or Paypal's own service, Xoom. Then you can choose to transfer to an Ecuadorian bank account or arrange for a cash pickup at a bank in Ecuador.

No, there is not. Moving small amounts of money into the country is relatively easy.

Sending cash out of Ecuador triggers an exit tax of 5% if transferring over $1,200. The $1,200 threshold is calculated from 3x monthly minimum wage ($400 in 2020).

Have I covered your favorite method here? Feel free to let me know in the comments if I've left anything out so I can update to include.

I have great service from ProduBanco. I transfer from Canada regularly. They charge a $10 fee.

Thanks for sharing. I actually tried to open a ProduBanco account 2 weeks ago. They wouldn't let me because I don't have a job in Ecuador (or a RUC as an independent contractor). I found this very strange, but apparently it's their new policy to try and stop illegal immigrants from opening accounts for nefarious means.

Hi Jason, I am living in Ecuador with a temporary residency visa but have still not opened an Ecuadorian Bank account. I have only tried transferring money to my boyfriends Banco Pichincha account from my Transfer Wise account, but it was bad.... I transferred $200 dollars and there was a charge of $40 when it reached his account, I am presuming from Banco Pichincha. So I have been somewhat traumatized by the experience! Is it right in thinking that an Online Money Transfer by WorldRemit is different from a normal international bank transfer than therefore wouldn't incur the same fees?

Any advice would be great. I want to open my own bank account but with such high fees it wouldn't be worth it.

Thank you!

Hey Grace, I suspect you are absolutely correct. I just tried to transfer into Ecuador via Wise and I received this message: "To send USD outside the US, we need to use the SWIFT network. It’s more expensive and slower, so it costs $3.2 extra and the transfer might take a day or two longer. Also note that intermediary banks and your recipient’s bank might charge extra fees". I suspect that either an intermediary bank or Pichincha (or both) slapped on some fees. I generally use Wise wherever possible, but I've never had luck with it in Ecuador.

You should not have the same problem with World Remit. I've transferred to Pichincha, Pacifico & JEP accounts with no additional fees other than the (reasonable) fees charged by World Remit.

I suggest giving it a go, and if all is good, then go ahead and open a local bank account. FYI - We just released this video on opening a bank account in Ecuador.

Please let us know how you get on 🙂

just open an account with JEP with $20 if your here legally then its no problem, Jep is a great credit union ive never had any problems with them

Thanks Dale. I also like JEP, but transferring into JEP internationally from Wise (or traditional bank transfers) still attracts significant fees as they don't transfer directly. The solution is to use an online transfer service (like World Remit) that transfers directly. Less time & fewer fees.

Dear Jason:

I would like to know exactly the procedure of transferring PayPal funds to a WorldRemit account as I have had a lot of trouble using PayPal since I do not have a US account or US issued credit card. Thanks so much. Russell Hagen

Hi! I also want to know that because I am in the same situation.

Hi

Did u successfully transfer monery to JEP by wise?Last time i transfer to JEP need to fisrt to pichincha miami, and still fail with pichincha miami even don't give out reason.Could u share me with information about JEP recipter informaion, Just want to double check with JEP's information, document JEP vendor me ever include error.Great thanks.

Hi Joe,

I hope you can shed some light into my predicament:

- I am Ecuadorian and married here before moving abroad.

- While abroad we divorced.

- I remarried with a Canadian while abroad and returned 21 years later with her.

- Legally, I am still married to my ex-wife here, so I can't help my wife with an ID card. She's here on a visa.

- As a result, all goods and services that we purchase here are under her name.

- I can't open a bank account without my ex-wife's ID number.

My wife and I don't work or have any commercial activities here; you can consider us "semi-retired".

While my wife and I try to sort out divorce/marriage dilemma, we have been successfully using the ATM card from her HSBC account to withdraw money from the Banco Bolivariano's (BB), as well as a few select ATMs from Banco Guayaquil (BG), all which support UnionPay. We've been doing this about once a week for the past four months.

On Tuesday we purchased a second-hand car worth around 15k. The seller agreed to three bank transfers of 5k each, across three days - again, using her HSBC account.

The car and the insurance are under her name.

We also went to a BB ATM twice in two days after buying the car, each time withdrawing the maximum $400 limit for car insurance, doctor's appointments and medication.

On Friday, I stopped by a BB ATM and this time it would only allow me to withdraw $200.

We waited until Saturday to see if we could withdraw any more cash, and we was greeted with a "Insufficient funds" message. We printed out the balance from the BB ATM and it indicated there were enough funds.

We tried with a BG ATM and it told us, "This operation is not available at this moment."

Come Sunday (today), and we were met with the same outcome.

We called HSBC, and they confirmed that the account and ATM card are perfectly fine.

We called UnionPay and they said there were no problems from their end.

That leaves us with Ecuador. I find it strange that both BB and BG would deny me any withdraw amount, and that perhaps there's a larger entity at work. I also thought that being able to withdraw only $200 when the same ATM had always let me withdraw $400 before means there's some accumulated total of transactions/money being enforced.

TL;DR:

Is there a cap on an "accumulated amount" of money being transferred into the country from a foreign bank into a local bank's ATM, and if so, what is that amount?

Could it be because we moved enough money to alert suspicion from the authorities, and our HSBC account has been flagged here?

Would any bank transaction from our HSBC account to an Ecuadorian bank account - say, a friend's - be flagged as well, and potentially the transfer amount frozen? Or for that matter, World Remit or Western Union?

Who or what authorities can I speak to regarding this situation?

If we are suspected of engaging in illegal activities, how can we prove otherwise?

We aren't sure what's wrong or who to talk to, and right now we're bumming 50 bucks here and 100 bucks there from our friends so we can get by, so any advice would immensely helpful.

Hey Sid,

I hear you. Yes, it's most likely a result of Ecuadorian Banks doing something weird. We can relate. Michelle's 20+ year old Banco de Pichincha account was closed by them last week. No notice was provided or anything. We're fighting it now, but consumer protection legislation here isn't super strong or helpful (at least for us so far).

To resolve your immediate cashflow problem I can suggest two options:

1) Use WorldRemit to send USD from your US/Canadian account (I assume you have a Canadian account) to a friend's bank account in Ecuador. Or, you can also elect a cash pickup instead of an account. This link will give you your 1st transfer for free. Use a small amount for the 1st transaction (ie $50) to ensure it goes through smoothly and then make larger transfers. Be careful not to use Transferwise (or Wise as they are now called) as they use an intermediary which charges high fees and takes longer.

2) Go into a larger Banco de Guayaquil branch and ask a teller to withdraw money using your ATM card. If there is any problem with the withdrawal limit, then they should be able to tell you this too.

There are definitely daily withdrawal limits and the banks do monitor incoming funds to comply with anti-money laundering legislation. But, I'd suspect each bank's policy on this is going to differ, so you'll only really know if you are able to talk to each bank. If the teller doesn't help you, one little trick we've pulled is to ask someone (like a security guard) for the name of the branch manager. Then, we go back later and ask for this person and don't leave until they solve our problem. It's a little on the aggressive side, but it works.

Please let us know how you get on!

I hope this helps other people, I work as freelance artist and I always have to receive payments from all over the world. I normally use Xoom, which is a Paypal service so it's super easy for my clients and it's normally instant. and the fees are really cheap too, like $5-10. I've also tried Skrill but the fees were absurd because it's SWIFT, I don't recommend that type of transfer.

Thanks Javier. I agree Xoom is a good option. I favor WorldRemit because they charge less fees for transferring into Ecuador. I did a quick fee comparison in this video if you're interested. Yeah, numerous online transfer companies like Skrill & Wise use SWIFT which just adds too many layers to the transaction causing more costs and delays.

Hi Johnson, I used your referral code to sign up for worldremit, unfortunately I found out that the only bank that accepts transfers is Guayaquil Bank, no more JEP, and I don't have an account with Guayaquil Bank, so it looks like I have to open an account with Guayaquil Bank to use worldremit for easy transfers.

Hey - thanks for the headsup. I've also had issues with WorldRemit lately since they've stopped the JEP bank integration. How annoying. I'm going to try the cash pickup option at Pichincha tomorrow for the 1st time. Hope it's not too painful. I'm also considering opening an account with Guayaquil Bank just so I can have cheaper/easier transfers.

Hello Jason! Great article! However, I think it has to be updated. Would you still recommend Worldremit nowadays (May 2022), or what option is best?

Also, Produbanco and Banco Bolivariano charge $10 for receiving international transfer (I know Pichincha charges a lot, but for the two above mentioned banks the fee is $10).

And finally, for the exit tax (Impuesto a la Salida de Divisas - ISD), the tax is currently of 4.5%. By the end of 2022 the tax will be reduced to 4%. There will be a reduction of 0.25% on July 1, and another reduction of 0.25% on October 1 to get to the 4% tax.